Washington Residency Laws

Excerpts ...

Student Classification

(1) For a student to be classified as a "resident" for tuition and fee purposes, the student must prove by evidence of a sufficient quantity and quality to satisfy the institution that the student:

(a) Is financially independent and has maintained a bona fide domicile in the state of Washington primarily for purposes other than educational for at least one year immediately prior to commencement of the first day of the semester or quarter for which the student has registered at any institution; or

(b) Is financially dependent with at least one parent or legal guardian who has maintained a bona fide domicile in the state of Washington for at least one year immediately prior to commencement of the first day of the semester or quarter for which the student has registered at any institution; or

(d) Has spent at least seventy-five percent of both junior and senior years in high school in this state, who has at least one parent or legal guardian who had been domiciled in the state for a period of at least one year within the five-year period before the student graduates from high school, and who has enrolled in an institution within six months of leaving high school. The student shall retain resident student status so long as the student remains continuously enrolled for three quarters or two semesters in any calendar year; or...

(the remainder was updated per Senate Bill 5194, effective 7/25/21 - see Residency Affidavit)

Establishment of a domicile

...The weight assigned to any given factor should depend on the ease with which it might be established and the degree to which it demonstrates commitment to domicile as a matter of common sense and as part of the individual's overall circumstances. Factors include, but are not limited to:(1) Location and duration of registration or payment of taxes or fees on any motor vehicle, mobile home, travel trailer, boat, or any other item or personal property owned or used by the person;(2) State and duration of any driver's license for the previous one year;(3) Location and duration of any continuous full-time employment of the previous one year;(4) Address and other pertinent facts listed on a true and correct copy of federal and state income tax returns for the calendar year prior to the year in which application is made;(5) Location and duration of any voter registration for the previous one year;(6) Location and duration of primary residence, evidenced by title, lease agreement, or monthly rental receipts for the previous one year;(7) Residence status in all secondary and postsecondary schools attended outside the state of Washington;(8) Location and duration of any checking accounts, savings accounts, and/or safety deposit boxes for the previous one year;(9) Address listed on selective service registration;(10) Location of membership in professional, business, civic or other organizations;(11) Receipt of benefits under a public assistance program;(12) State claimed as residence for obtaining eligibility to hold a public office or for judicial actions;(13) State claimed as residence for obtaining state hunting or fishing licenses;(14) State in which a custodial parent or legal guardian has a child attending public schools.

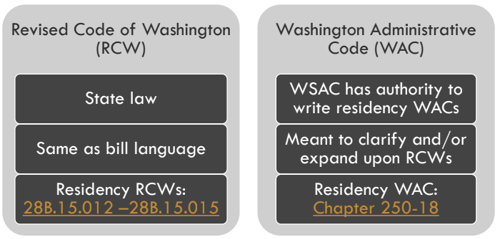

RCW vs WAC

The RCW has the latest information when there is a difference. WAC was last updated in 2017, though is expected to be updated early 2021.

State of Washington Residency Laws

Washington residency policies are set by the State of Washington and are applied by Washington's public colleges and universities. The Revised Code of Washington (RCW) bills are passed by the legislature and are the most current. The Washington Administrative Code (WAC) is updated by Washington Student Achievement Council (WSAC) and is meant to expand upon or clarify the RCW.

Residency Laws

- RCW 28B.15.012: Classification as resident or nonresident student - Definitions.

- RCW 28B.15.013: Classification as resident or nonresident student - Standards for determining domicile in the state.

- RCW 28B.15.0131: Resident tuition rates- American Indian students.

- RCW 28B.15.0139: Resident tuition rates- Border county higher education opportunity project.

- RCW 28B.15.014: Exemption from nonresident tuition fees differential.

- WAC 250-18: Residency Status for Higher Education.

- WAC 250-18-035: Evidence of financial dependence or independence.

Domicile

(5) The term "domicile" shall denote a person's true, fixed and permanent home and place of habitation. It is the place where the student intends to remain, and to which the student expects to return when the student leaves without intending to establish a new domicile elsewhere. The burden of proof that a student, parent or guardian has established a domicile in the state of Washington primarily for purposes other than educational lies with the student

Nonresident Student

(4) The term "nonresident student" shall mean any student who does not qualify as a "resident student" under provisions of this section... a nonresent student shall include: (a) A student attending an institution with the aid of financial assistance provide by another state or governmental unit or agency...